What is the current regulatory status of STOs at EU level

Introduction

A Security Token Offering (STO) occurs when a Blockchain token is sold to a buyer as an investment. The token that exists on the Blockchain can be used to represent the value of real-world assets, such as works of art, real estate and intellectual property, among others. A token that represents these real-world assets can then be sold as a security. A security is an investment contract, where the buyer gives money to the seller with the expectation of a return on the investment. The return on the investment relies on a third party putting in some form of work, such as restoring a valuable piece of art to its original condition, developing real estate or creating a valuable piece of intellectual property.

The token is seen as an investment under the law, rather than a utility token, the value of which is based on its use rather than return on investment. A real-world example of this would be a security based on casks of wine. A company may want to raise money to store and maintain casks of wine over many years, before they reach maturity and are suitable for selling. While the wine is drinkable and certainly could be put to use, ownership of the token is a security, not something that can be exchanged for the wine itself.

In Europe, there is currently a promising outlook for securities and STOs. In this post we will examine the different elements influencing STOs in Europe these days.

Securities in Europe

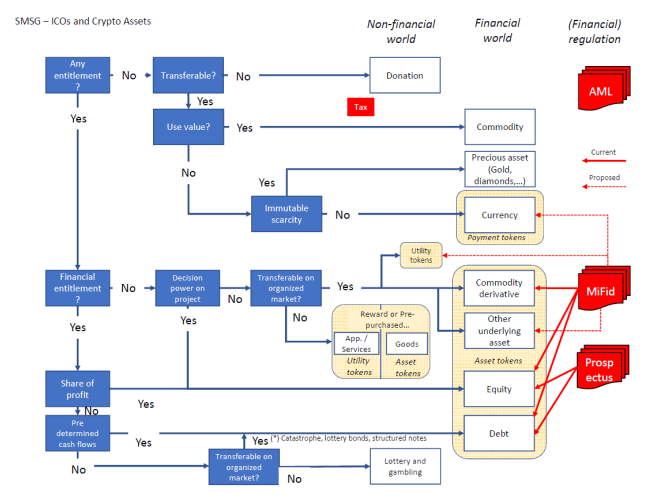

A token that exists on a Blockchain is a digital asset. However, not all digital assets are the same. There are a number of ways in which a digital asset can be classified. The Securities and Markets Stakeholder Grouppublished an advisory report to the European Securities and Markets Authority (ESMA), focused on classifying digital assets based on the following questions:

- Does it give the owner an entitlement against the issuer? If so, is it an entitlement in kind or a monetary entitlement? If it is deemed a monetary entitlement, is it profit sharing, a predetermined entitlement, or another undetermined kind of entitlement?

- Is it transferable?

- Is it scarce, and how is scarcity controlled?

- Does it give decision power on the project of the issuer?

On the basis of these questions, the report shows how different EU legislation could be applicable for different types of digital tokens. This is shown in the below diagram.

- -

-

Within this diagram, The Securities and Markets Stakeholder Group outlines that both Equity and Debt-based tokens representing an asset would require a prospectus. Within the EU, a prospectus is a common requirement for securities. A prospectus is a legal document which describes top-line information, such as a company’s main line of business, its finances and shareholder structure, as well as the securities that are being issued to investors. This is meant to provide investors with the minimum information needed to make an investment decision.

There are many advantages and disadvantages to prospectus requirements for securities within the EU. On the one hand, the rules provide a standard process for registering securities across Europe. They also allow securities to be traded across the EU without requiring the seller to apply to individual countries, thereby facilitating cross-border issuance. However, prospectus requirements can prohibit smaller companies from issuing securities and accessing capital, due to the costly and time-consuming nature of issuing a prospectus.

The outlook for securities in Europe

The outlook for securities looks extremely bright in the EU, due in large part to friendlier regulations being introduced in 2019. ESMA will allow companies to issue securities without the need for a prospectus up to the value of €1 million. This is ten times more than the historical cap of €100,000. By increasing the limit to €1 million, the EU makes it easier and cheaper for small businesses to access capital markets. It will also be possible to increase this limit to €8 million, still without a prospectus.

What does this mean for STOs in Europe?

These regulations will make it easier than ever for small to medium-size companies to issue securities without the need of a prospectus in the EU. This means that Security Token Offerings may become favorable for startups and small to medium-sized companies. This would not only spur innovation, more importantly, it would also create jobs and further down the line a new industry.

Conclusion

Security tokens are set to play a large role in the future of the global economy. They provide liquidity to traditionally illiquid assets and have the potential to grant access to asset classes previously unattainable to retail investors. The outlook for securities looks extremely positive within the EU, with new rules allowing securities to be issued up to the value of €1 million without the need for a prospectus.

Author: Conor Keville, Emurgo